The Human Resources Development Fund (HRDF), managed by HRD Corp, plays a crucial role in enhancing the skills of Malaysia’s workforce. However, many employers are unaware that they can claim refunds for HRDF levies and interest under specific conditions.

This guide aims to educate Malaysian employers on the HRDF refund process, eligibility, and key considerations to make the most out of their HRDF contributions.

What is HRDF Malaysia?

HRDF Malaysia is a mandatory levy collected from employers to finance employee training and development. As a registered employer, you contribute 1% of your employees’ monthly wages to HRDF. These HRDF funds are then used to upskill employees, driving productivity and enhancing workplace competitiveness.

Are HRDF Contributions Refundable?

Yes, HRDF contributions are refundable under certain circumstances. Employers can claim HRDF refunds for unutilized levies, interest accrued, or other eligible scenarios, provided they meet the stipulated requirements and follow the correct application process.

Eligibility for HRDF Refunds

Employers may be eligible for a refund in the following cases:

- Overpayment: If you have made excess contributions beyond the required HRDF levy amount.

- Interest Charges: Refunds for HRDF interest charged due to specific errors or discrepancies.

- Closure or Deregistration: When a company closes or deregisters from HRDF, unused levies can be refunded.

- Expired Levies: Levies not utilized within the stipulated period (two years as of 2020) may be forfeited. However, refunds can be processed if applied for within the allowable time frame.

How to Apply for an HRDF Refund

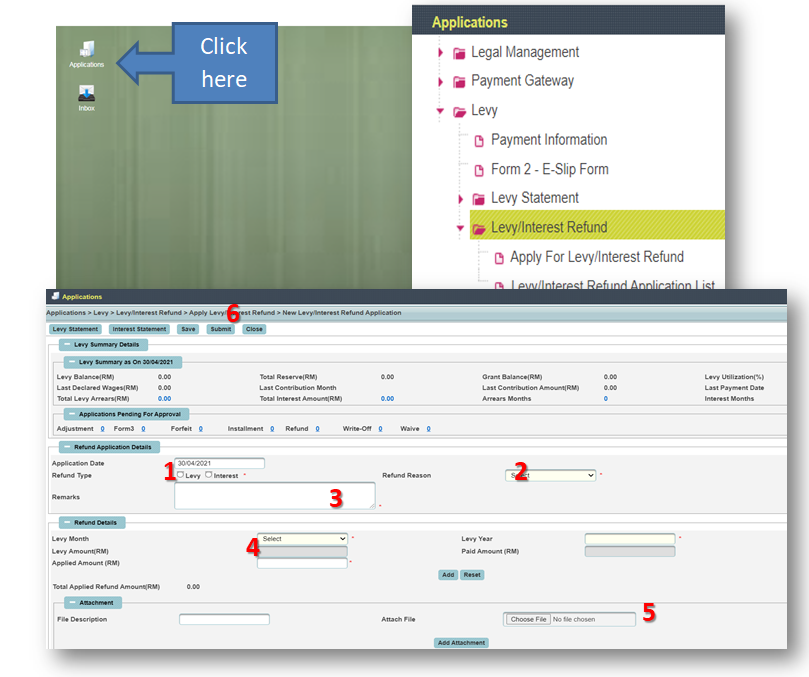

HRDF refund applications are processed through the eTRiS (Electronic Training Information System) platform. Follow these steps to ensure a smooth application process:

The Human Resources Development Fund (HRDF) in Malaysia allows employers to apply for refunds of levies or interest under specific circumstances. To initiate a refund, employers should use the eTRiS system and follow these steps:

1. Login to eTRiS

- Access the HRD Corp portal (hrdcorp.gov.my).

- Use your registered credentials to log in to the eTRiS system.

2. Initiate a Refund Request

- Navigate to the “Refund” section.

- Choose the type of refund: Levy or Interest.

3. Provide Details

- Select the reason for the refund from the dropdown menu.

- Enter remarks to justify the refund application.

4. Specify Refund Amount

- Identify the levy month and year.

- Input the amount you wish to claim and click Add.

5. Attach Supporting Documents

- Include mandatory documents such as:

- Payroll summaries.

- Payment slips.

- Bank account details.

- Ensure all attachments meet HRD Corp’s specifications.

6. Submit Application

- Review your application for accuracy.

- Click Submit to send your refund request for processing.

It’s important to note that unutilized HRDF levy may be forfeited if not claimed within a specified period. As of January 1, 2020, this period was reduced from five years to two years to encourage employers to invest in employee training and development.

For detailed guidance on applying for HRDF refunds via eTRiS, refer to HRD Corp’s official documentation.

Processing Time and Follow-Up

HRD Corp typically processes refund applications within 14 to 30 days, depending on the complexity of the request and the completeness of your submission. Employers can track the status of their HRDF refund applications directly through eTRiS.

Avoiding HRDF Levy Forfeiture

One of the most significant changes implemented by HRD Corp is the reduction in HRDF levy forfeiture timelines from five years to two years, effective January 1, 2020. To avoid forfeiture:

- Regularly check your HRDF account balance.

- Plan training programs proactively to utilize levies.

- Apply for refunds promptly for unutilized levies.

Key HRDF Refund Considerations for Malaysia Employers

- Levy Utilization: Invest in employee training programs to make the most of your contributions. HRDF offers numerous grant schemes that align with various industries and needs.

- Documentation Accuracy: Ensure all supporting documents are complete and accurate before submission to avoid delays.

- Compliance: Stay updated on HRDF policies to ensure compliance and avoid penalties.

Why HRDF Refunds Matter

HRDF refunds provide financial relief for employers and encourage active participation in workforce development initiatives. By reclaiming unutilized levies or resolving interest discrepancies, employers can reinvest HRDF funds into meaningful employee training and development programs.

Maximize Your HRDF Benefits Today with HRDF Claimable Outdoor Team Building Programs Selangor!

If you’re looking for a dynamic and engaging outdoor team building experience in Malaysia, OE Group offers a comprehensive HRDF claimable team building program that combines leadership training with exciting outdoor activities. The OE Team specializes in customizable team-building experiences that are perfect for corporate teams aiming to improve collaboration, communication, and leadership skills.

Located only 45 minutes from Kuala Lumpur, the OE Resort provides a unique setting for corporate team building activities, combining interactive exercises with luxurious amenities such as space capsule accommodations and gourmet dining

Their programs include a range of activities like:

- Leadership Skill Development: Guided by certified trainers and vocational experts, your team will engage in exercises that foster leadership qualities and team cohesion.

- Outdoor Adventure Activities: Teams participate in interactive tasks designed to enhance problem-solving, trust, and adaptability, all while enjoying the outdoor setting.

- Custom Itinerary and Guidance: With options like space capsule accommodations and forest dining, the OE team ensures a unique experience with professional outdoor instructors to guide activities safely and effectively.

Perfect for teams ranging from small groups to large corporate teams, these activities aim to push teams out of their comfort zones while ensuring everyone works toward common team building objectives. Best of all, the program is 100% HRDF claimable, allowing your company to optimize training budgets while enhancing team performance.

Get more information and tailor the perfect team building event by visiting OE Group’s official corporate team building page, or contact us at:

- 601115608888 (Ben Liu)

- 60182296599 ( Zoey Leong)

Conclusion on HRDF Refund

HRDF is more than just a statutory obligation; it’s an opportunity for Malaysian employers to enhance their workforce capabilities. Understanding the HRDF refund process ensures you’re not leaving unutilized funds on the table. By leveraging HRDF refunds and training grants, employers can build a more skilled and competitive workforce, driving long-term business growth.

For more information on HRDF refunds or to access the eTRiS portal, visit hrdcorp.gov.my.