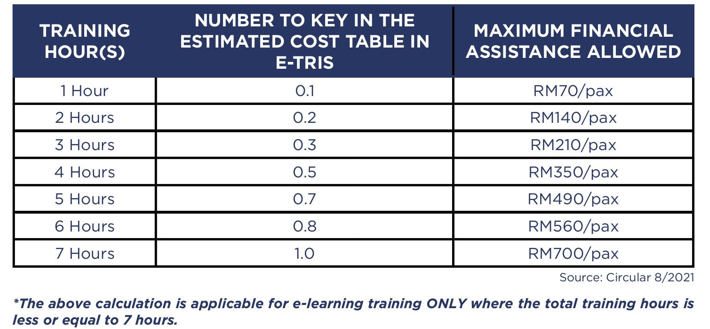

In a move that signals a significant shift towards greater flexibility in workforce training, Malaysia’s Human Resource Development Corporation (HRD Corp) has introduced an enhanced policy that allows employers to make hourly-based claims for training programs.

Alongside this, HRD Corp has raised the ceiling for claimable course fees, making it easier for businesses to provide high-quality HRDF training for their employees without being constrained by previous cost limitations. These updates reflect HRD Corp’s ongoing commitment to helping Malaysian companies stay competitive by investing in the skills and development of their workforce.

In a move that signals a significant shift towards greater flexibility in workforce training, Malaysia’s Human Resource Development Corporation (HRD Corp) has introduced an enhanced policy that allows employers to make hourly-based claims for training programs.

Alongside this, HRD Corp has raised the ceiling for claimable course fees, making it easier for businesses to provide high-quality HRDF training for their employees without being constrained by previous cost limitations. These updates reflect HRD Corp’s ongoing commitment to helping Malaysian companies stay competitive by investing in the skills and development of their workforce.

- 1 Hour: RM70 per participant.

- 2 Hours: RM140 per participant.

- 3 Hours: RM210 per participant.

- 4 Hours: RM350 per participant.

- 5 Hours: RM490 per participant.

- 6 Hours: RM560 per participant.

- Up to 7 Hours: RM700 per participant.

Additional Notes

- Single Allowance Rule: Employers are entitled to claim only one type of allowance (meal or trainee) per HRDF training location.

- Four-Hour Training Limit: Half of financial assistance is claimable for training lasting only four hours.

- Documentation Requirements: Claims by Training Providers must include Joint Declaration 14, Attendance T3, Invoice to HRD Corp, and system-generated attendance.

- Verification: HRD Corp may request additional documentation for verification.

- Terms Revision: HRD Corp retains the right to revise terms as necessary.

Benefits of the Enhanced Hourly-Based HRDF Claims Structure

The transition to hourly-based HRDF claims offers multiple advantages for Malaysian businesses:

- Flexibility in Training Scheduling:

Employers can tailor training sessions to fit within their operational hours without committing to full-day programs. This flexibility is especially useful for industries that require frequent, short training sessions for compliance updates, new technology adoption, or skill refreshers. - Cost Efficiency:

By claiming on an hourly basis, employers can maximize the utilization of HRD Corp funds. For example, companies can claim just the required hours needed to train specific teams, reducing unnecessary training expenses and avoiding a one-size-fits-all training duration. - Support for Diverse Training Needs:

Hourly-based HRDFclaims make it more feasible to fund a variety of training programs, including online learning, microlearning sessions, and specialized workshops. Employers can now access a broader range of HRDF training resources, enhancing employee skills across multiple competencies.

Step-by-Step Guide on Using the HRD Corp Allowable Cost Matrix

A) STEP 1: Determine the Type of Training

Identify the specific type of training to ensure you follow the correct set of rules within the matrix. Training types include:

- In-House Training: Training conducted on the company’s premises or at an external venue but led by internal trainers.

- Public Training: Training that’s open to the public, which may be conducted by HRD Corp-approved providers.

- Overseas Training: For programs held internationally or involving overseas trainers.

- Seminar/Conference: Either local or overseas seminars/conferences that are eligible for claims.

- Online Training: Includes public online HRDF training, in-house online training (ROT), e-learning, or certification-based training programs.

Correctly identifying the type of training is crucial as each has different allowable costs, documentation requirements, and eligibility criteria.

B) STEP 2: Decide the Venue of Training (Applicable for In-House Training Only)

For in-house training, you’ll need to determine if the training will take place:

- On Company Premises: Training occurs on the company’s property, typically requiring fewer logistical arrangements and lower allowances.

- External Venue: If the training is held offsite, additional costs like venue rental and transportation may be eligible for claims.

The chosen venue impacts the cost allowances for transportation, lodging (if applicable), and other venue-related expenses.

C) STEP 3: Choose the Type of Trainer (Applicable for In-House Training Only)

For in-house HRDF training, selecting the trainer type is essential to determine allowable costs:

- Internal Trainer: A company employee or personnel leading the training. Allowances for internal trainers differ from external trainers.

- External Trainer: A trainer hired from outside the organization. External trainers typically have higher allowable costs and may require additional documentation, especially if they need travel and accommodation support.

The trainer type affects daily allowances, eligibility for travel reimbursement, and any additional support expenses.

D) STEP 4: Read the Details of Allowable Costs by Referring to the Eligibility Columns

Once you have identified the training type, venue, and trainer, review the Eligibility columns in the matrix for specific allowable costs. This includes:

- Course Fees: Maximum daily or per participant rates that can be claimed, varying by training type.

- Trainer/Trainee Allowances: Daily or meal allowances based on the training format and location.

- Travel and Transportation: Reimbursement rates for air travel, local transportation, and related travel expenses.

- Consumable Training Materials: Limit on consumable items, usually capped at RM100 without itemization, or more if itemized.

Each column in the matrix provides the eligibility and limits for different cost categories, along with supporting document requirements for each claim type. Ensure to follow these specifics to avoid rejections or delays in claim processing.

How the Increased Course Fee Cap Empowers Malaysian Businesses

The raised course fee ceiling is a response to the increasing costs of high-quality training in Malaysia. With the daily cap raised to RM10,500, HRD Corp is allowing companies to:

- Access top-tier training providers for specialized courses.

- Invest in international trainers or advanced certifications that were previously cost-prohibitive.

- Ensure that the latest skills are imparted by professionals with industry-leading expertise.

For companies aiming to develop their workforce in high-tech fields, the increased cap is particularly advantageous. Advanced HRDF training often requires significant investment, and the new ceiling enables companies to provide such training without exceeding HRD Corp’s limits.

Boost Your Team’s Performance with No.1 HRDF Claimable Outdoor Team Building in Malaysia!

If you’re looking for a dynamic and engaging outdoor team building experience in Malaysia, OE Group offers a comprehensive HRDF claimable team building program that combines leadership training with exciting outdoor activities. The OE Team specializes in customizable team-building experiences that are perfect for corporate teams aiming to improve collaboration, communication, and leadership skills.

Located only 45 minutes from Kuala Lumpur and Airport, the OE Resort provides a unique setting for corporate team building activities, combining interactive exercises with luxurious amenities such as space capsule accommodations and gourmet dining

Their programs include a range of activities like:

- Leadership Skill Development: Guided by certified trainers and vocational experts, your team will engage in exercises that foster leadership qualities and team cohesion.

- Outdoor Adventure Activities: Teams participate in interactive tasks designed to enhance problem-solving, trust, and adaptability, all while enjoying the outdoor setting.

- Custom Itinerary and Guidance: With options like space capsule accommodations and forest dining, the OE team ensures a unique experience with professional outdoor instructors to guide activities safely and effectively.

Perfect for teams ranging from small groups to large corporate teams, these activities aim to push teams out of their comfort zones while ensuring everyone works toward common team building objectives. Best of all, the program is 100% HRDF claimable, allowing your company to optimize training budgets while enhancing team performance.

Get more information and tailor the perfect team building event by visiting OE Group’s official corporate team building page, or contact us at:

- 601115608888 (Ben Liu)

- 60182296599 ( Zoey Leong)

Final Thoughts

The latest updates from HRD Corp signal a forward-thinking approach that aligns with Malaysia’s ambitions to build a skilled, competitive workforce. By introducing hourly-based HRDF claims and increasing the allowable course fee cap, HRD Corp is empowering businesses to invest in employee development flexibly and sustainably. As companies across Malaysia look to upskill their teams, understanding and utilizing these enhancements in the Allowable Cost Matrix can make a significant difference in their HRDF training programs and, ultimately, their market competitiveness.

For more information on these policy changes, check out the detailed coverage by NST and The Edge Malaysia, or visit the HRD Corp official website.